5 Mistakes Most First-Time Home Buyers Make

1. Overlooking the Importance of Financial Readiness Many first-time homebuyers dive into the market without fully grasping the financial commitments involved. Beyond the down payment, there are often overlooked costs such as property taxes, insurance, and maintenance. To avoid this pitfall, creat

Categories

- All Blogs (170)

- Aliso Viejo, California (2)

- Anaheim, Calfornia (3)

- Beach House (2)

- Best places for surfers (1)

- Bixby Knolls (1)

- Buena Park, California (2)

- Buying and Selling Real Estate (28)

- California (2)

- California Beach House (2)

- Cerritos, California (1)

- Costa Mesa, California (1)

- Current Market (1)

- Cypress, CA (4)

- Dana Point, California (1)

- Downey, California (1)

- Equestrian (1)

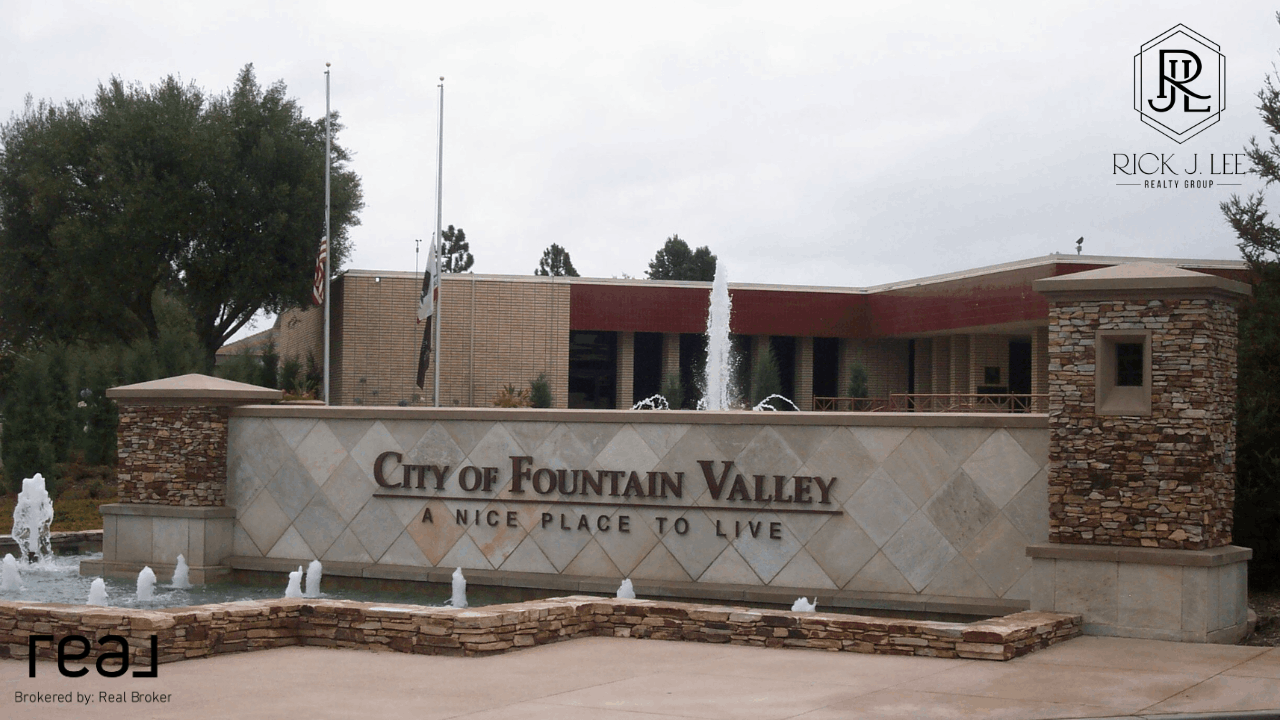

- Fountain Valley, California (5)

- FSBO (1)

- Fullerton, California (1)

- Fur Parents (1)

- Garden Grove California (6)

- History (2)

- Holiday in Long Beach (1)

- home (12)

- Home Improvement (1)

- home value (7)

- Huntington Beach (5)

- Irvine, California (3)

- La Habra, California (1)

- Laguna Niguel, California (1)

- Lake Forest, California (1)

- Lakewood Event (2)

- Lakewood, California (16)

- Lifestyle (1)

- Listing (1)

- Long Beach Events (1)

- Long Beach Neighborhood (2)

- Long Beach, California (20)

- Los Alamitos (1)

- Los Alamitos, California (1)

- Market Reports (7)

- Mission Viejo, California (1)

- Mortgage Lender (1)

- Moving to Aliso Viejo, California (2)

- Moving to Anaheim, California (3)

- Moving to Buena Park, California (2)

- Moving to California (11)

- Moving to Cerritos, California (1)

- Moving to Costa Mesa, California (1)

- Moving to Cypress, CA (3)

- Moving to Dana Point, California (1)

- Moving to Downey, California (1)

- Moving to Fountain Valley, California (4)

- Moving to Fullterton, California (1)

- Moving to Garden Grove, California (5)

- Moving to Huntington Beach (5)

- Moving to Irvine, California (3)

- Moving to Lakewood (2)

- Moving to Lakewood, California (4)

- moving to Long Beach, California (13)

- Moving to Los Alamitos, California (1)

- Moving to Los Angeles (1)

- Moving to Mission Viejo, California (1)

- Moving to Newport, California (3)

- Moving to Orange County, California (20)

- Moving to Orange, California (1)

- Moving to Placentia, California (1)

- Moving to Rossmoor, California (1)

- Moving to San Clemente, California (2)

- Moving to Seal Beach, California (2)

- Moving to Signal Hill, California (2)

- Moving to Stanton, California (1)

- Moving to Tustin, California (2)

- Moving to Westminster, California (2)

- Newport Beach, California (3)

- Orange County, California (8)

- Orange, California (2)

- Placentia, California (1)

- Real Estate (34)

- Real Estate Agent (25)

- Rossmoor, California (1)

- San Clemente, California (2)

- San Juan Capistrano, California (1)

- Saving Money (1)

- Seal Beach, California (3)

- Signal Hill, California (3)

- Social Media (1)

- Stagnation (1)

- Stanton, California (1)

- Success Story (1)

- surfing (1)

- Tips in Moving (1)

- Tustin, California (3)

- Westminster, California (2)

Recent Posts

Lakewood Events for March & April 2025

Long Beach Cracks Down on Airbnb and Short-Term Rentals with Stricter Rules

Lakewood Community Garage Sale – February 8th 7am-12pm!

Tips for Choosing the Right Mortgage Lender in Long Beach, CA

What You Need To Know About Market Stagnation When Pricing Your Home

What you Need to Know About Buying a Home in the Current Market

Why People are Moving to Fountain Valley

7 Ways to Save Money When Buying your Next Home

5 Mistakes Most First-Time Home Buyers Make

The Secret Of Pricing Homes In Orange County’s Current Market