7 Ways to Save Money When Buying your Next Home

1. Understanding Your Budget: The Foundation of Financial Success When embarking on your home-buying journey, it all begins with a solid understanding of your budget. Be Realistic: Assess your financial situation objectively, considering not just the purchase price but also additional co

Categories

- All Blogs (170)

- Aliso Viejo, California (2)

- Anaheim, Calfornia (3)

- Beach House (2)

- Best places for surfers (1)

- Bixby Knolls (1)

- Buena Park, California (2)

- Buying and Selling Real Estate (28)

- California (2)

- California Beach House (2)

- Cerritos, California (1)

- Costa Mesa, California (1)

- Current Market (1)

- Cypress, CA (4)

- Dana Point, California (1)

- Downey, California (1)

- Equestrian (1)

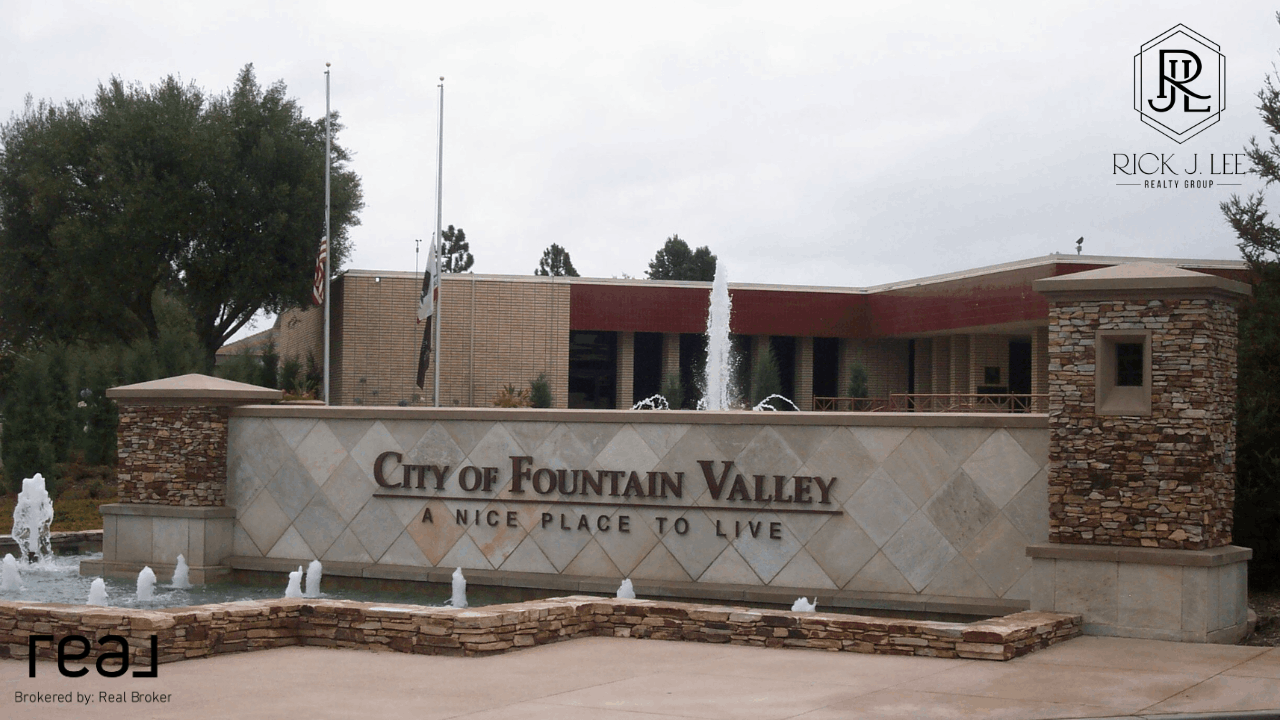

- Fountain Valley, California (5)

- FSBO (1)

- Fullerton, California (1)

- Fur Parents (1)

- Garden Grove California (6)

- History (2)

- Holiday in Long Beach (1)

- home (12)

- Home Improvement (1)

- home value (7)

- Huntington Beach (5)

- Irvine, California (3)

- La Habra, California (1)

- Laguna Niguel, California (1)

- Lake Forest, California (1)

- Lakewood Event (2)

- Lakewood, California (16)

- Lifestyle (1)

- Listing (1)

- Long Beach Events (1)

- Long Beach Neighborhood (2)

- Long Beach, California (20)

- Los Alamitos (1)

- Los Alamitos, California (1)

- Market Reports (7)

- Mission Viejo, California (1)

- Mortgage Lender (1)

- Moving to Aliso Viejo, California (2)

- Moving to Anaheim, California (3)

- Moving to Buena Park, California (2)

- Moving to California (11)

- Moving to Cerritos, California (1)

- Moving to Costa Mesa, California (1)

- Moving to Cypress, CA (3)

- Moving to Dana Point, California (1)

- Moving to Downey, California (1)

- Moving to Fountain Valley, California (4)

- Moving to Fullterton, California (1)

- Moving to Garden Grove, California (5)

- Moving to Huntington Beach (5)

- Moving to Irvine, California (3)

- Moving to Lakewood (2)

- Moving to Lakewood, California (4)

- moving to Long Beach, California (13)

- Moving to Los Alamitos, California (1)

- Moving to Los Angeles (1)

- Moving to Mission Viejo, California (1)

- Moving to Newport, California (3)

- Moving to Orange County, California (20)

- Moving to Orange, California (1)

- Moving to Placentia, California (1)

- Moving to Rossmoor, California (1)

- Moving to San Clemente, California (2)

- Moving to Seal Beach, California (2)

- Moving to Signal Hill, California (2)

- Moving to Stanton, California (1)

- Moving to Tustin, California (2)

- Moving to Westminster, California (2)

- Newport Beach, California (3)

- Orange County, California (8)

- Orange, California (2)

- Placentia, California (1)

- Real Estate (34)

- Real Estate Agent (25)

- Rossmoor, California (1)

- San Clemente, California (2)

- San Juan Capistrano, California (1)

- Saving Money (1)

- Seal Beach, California (3)

- Signal Hill, California (3)

- Social Media (1)

- Stagnation (1)

- Stanton, California (1)

- Success Story (1)

- surfing (1)

- Tips in Moving (1)

- Tustin, California (3)

- Westminster, California (2)

Recent Posts

Lakewood Events for March & April 2025

Long Beach Cracks Down on Airbnb and Short-Term Rentals with Stricter Rules

Lakewood Community Garage Sale – February 8th 7am-12pm!

Tips for Choosing the Right Mortgage Lender in Long Beach, CA

What You Need To Know About Market Stagnation When Pricing Your Home

What you Need to Know About Buying a Home in the Current Market

Why People are Moving to Fountain Valley

7 Ways to Save Money When Buying your Next Home

5 Mistakes Most First-Time Home Buyers Make

The Secret Of Pricing Homes In Orange County’s Current Market